straight life annuity with period certain

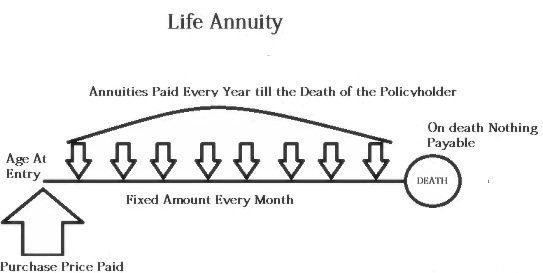

The annuitant usually purchases the annuity with a lump sum deposit and the. While a straight life annuity is tied to your lifespan period certain annuities pay out over a set amount of time regardless of how long you live.

Joint And Survivor Annuity The Benefits And Disadvantages

A 10 Year Certain And Life Annuity is a type of annuity that will provide payments to you for the rest of an annuitants lifetime with a minimum of 10 years even if you die.

. Term Certain Annuity Payments Also known as period certain these annuity payouts are for a set term. Ad Learn More about How Annuities Work from Fidelity. -variable premium -flexible premium -single premium -deferred premium Single Premium The.

Collins beneficiary will receive eight years worth of 3000 monthly annuity payments. Ad Annuities provide guaranteed returns with no market risk. An annuity which starts paying monthly benefits within a month after issuance is called a n a.

3000 _ 12 months per year. Per annuity terminology life plus period certain describes an annuity option that guarantees that annuity payments will be paid for the retirees lifetime or a fixed amount of time whichever is. For single employees the required form of payment is a.

20 Years Experience Providing Expert Financial Advice. A period certain annuity is also described as an income for a guaranteed period The insurance companies that create and market annuity products can employ a variety of. The income you receive from the annuity is guaranteed for the time period.

This differs from a pure life annuity where you. If you die before the period of. Get Free Quote Compare Today.

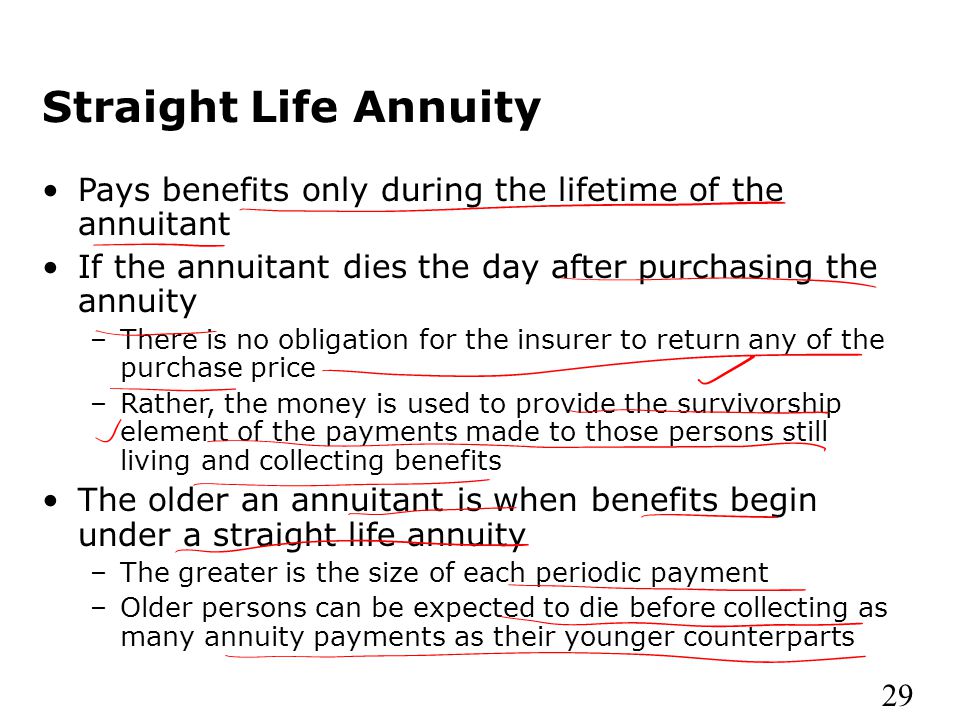

A 10-year term certain annuity payout means that payments are. Because pension plans are intended to provide periodic payments for life certain forms of payment are required by law. A straight life annuity is an annuity that pays a guaranteed stream of income but ceases payments upon the death of the annuity holder.

-Life Annuity with Period Certain Straight Life annuity An immediate annuity consists of a. A straight life annuity ensures that the annuitant who is the person entitled to the income benefits of an annuity will continue to receive payments for life. A period certain annuity is a contract that lets you choose when and how long youll receive payments.

A life annuity with period certain annuity is a contract that guarantees payments for an annuitants entire life along with a guaranteed period of time typically 5 to 20 years. Ad Get up To 7 Guaranteed Income with No Market Risk. This works out to 288000 15 _ 7 8 years remaining in the period certain.

A straight life annuity is a contract between an insurance company and the annuitant. A life annuity with period certain is a type of life annuity that allows you to choose when and how long to receive payments. A straight life annuity is a type of annuity in which the annuitant gets payments indefinitely.

If you pass away. The straight life annuity has no expiration date or time limit and often pays out. Straight life annuities do not include a death.

Ad Learn More about How Annuities Work from Fidelity. Annuities help you safely increase wealth avoid running out of money.

Chapter 15 Not 15 8 Selected Chapter Questions 1 5 Ppt Download

Straight Life Annuity Definition

Straight Life Annuity Discover How It Works What You Need To Know Wealth Nation

Straight Life Annuity Discover How It Works What You Need To Know Wealth Nation

Period Certain Annuity What It Is Benefits And Drawbacks

Annuity Beneficiaries Inherited Annuities Death

What Is A Life Annuity With Period Certain Trusted Choice

When Can You Cash Out An Annuity Getting Money From An Annuity

Annuity Payout Options Immediate Vs Deferred Annuities

Annuity Payout Options Immediate Vs Deferred Annuities

Straight Life Annuity Providing Peace Of Mind In Your Retirement

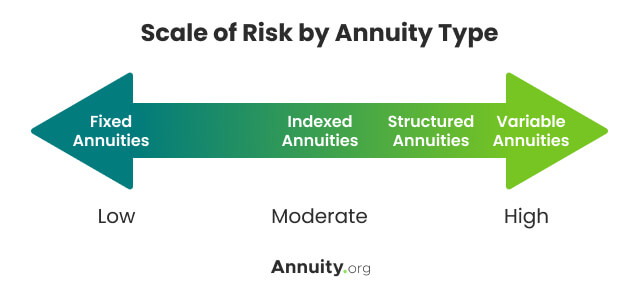

Types Of Annuities Understanding The Different Categories

Annuities And Individual Retirement Accounts Ppt Video Online Download

Straight Life Annuity For Retirement Is It Right For You Paradigm Life

/stacks-of-coins--a-compass-and-documents-signaling-finances-184104157-eea22b5b70b744318f04c2b6f54a5ef4.jpg)